If you use Paypal you’ve surely received an email at some point asking you to confirm your taxpayer status. This may have shaken you up momentarily, but this doesn’t affect you unless you’re a US citizen.

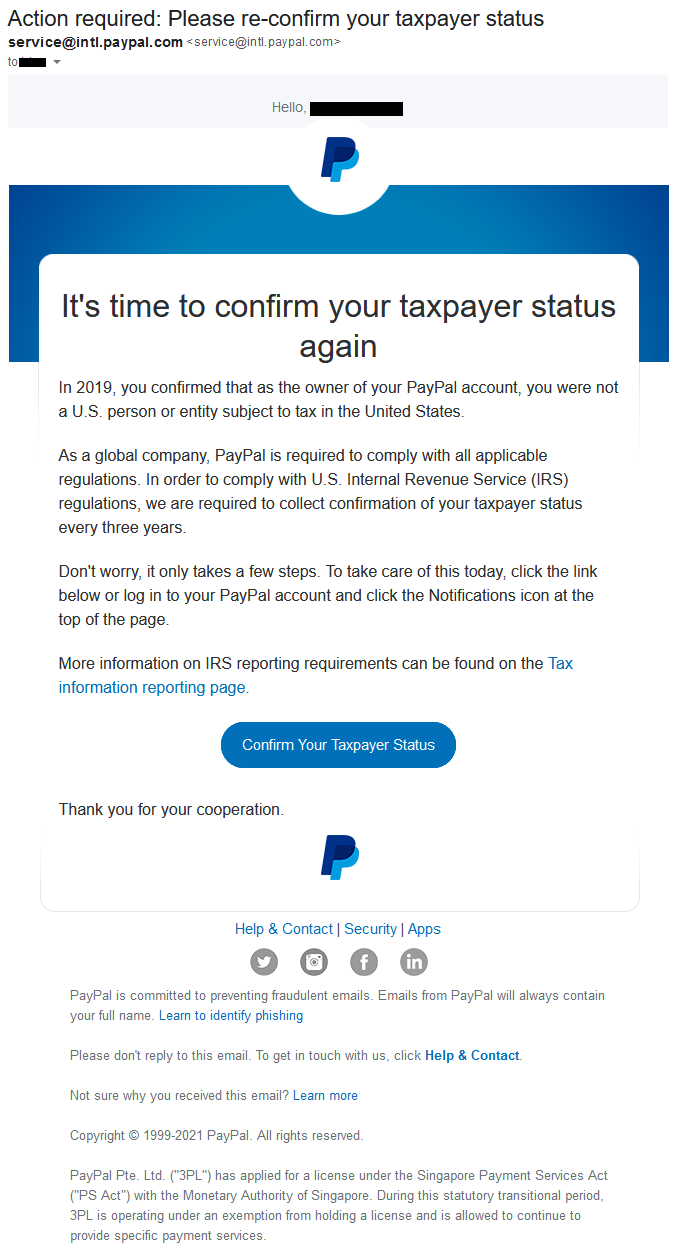

It’s time to confirm your taxpayer status again

In 2019, you confirmed that as the owner of your PayPal account, you were not a U.S. person or entity subject to tax in the United States.

As a global company, PayPal is required to comply with all applicable regulations. In order to comply with U.S. Internal Revenue Service (IRS) regulations, we are required to collect confirmation of your taxpayer status every three years.

Don’t worry, it only takes a few steps. To take care of this today, click the link below or log in to your PayPal account and click the Notifications icon at the top of the page.

More information on IRS reporting requirements can be found on the Tax information reporting page.

Why is Paypal asking for this?

The reason Paypal asks for this is the US Government, or the IRS (Internal Revenue Service). The only country in the world that taxes its citizens on their worldwide income is the United States of America. Most other countries consider you a tax resident if you spend more than 6 months per year in that country, and if you don’t then they don’t require you to pay taxes there.

The US is also probably the only country in the world that has the power to demand by every bank and financial institution to send them the information of any US citizen using their services (except maybe from Chinese and Russian and a few other countries institutions).

Paypal is no exception, and so every once in a while they ask their users to confirm their taxpayer status.

Here is what Paypal has to say about it – What is a Certificate of Foreign Status (tax Form W8 BEN/BEN-E)? Why do I need to provide this?

Can I ignore this?

No, you cannot ignore it. Paypal gives you a few weeks to get it done, but if you don’t do it then eventually they will impose limits on your account.

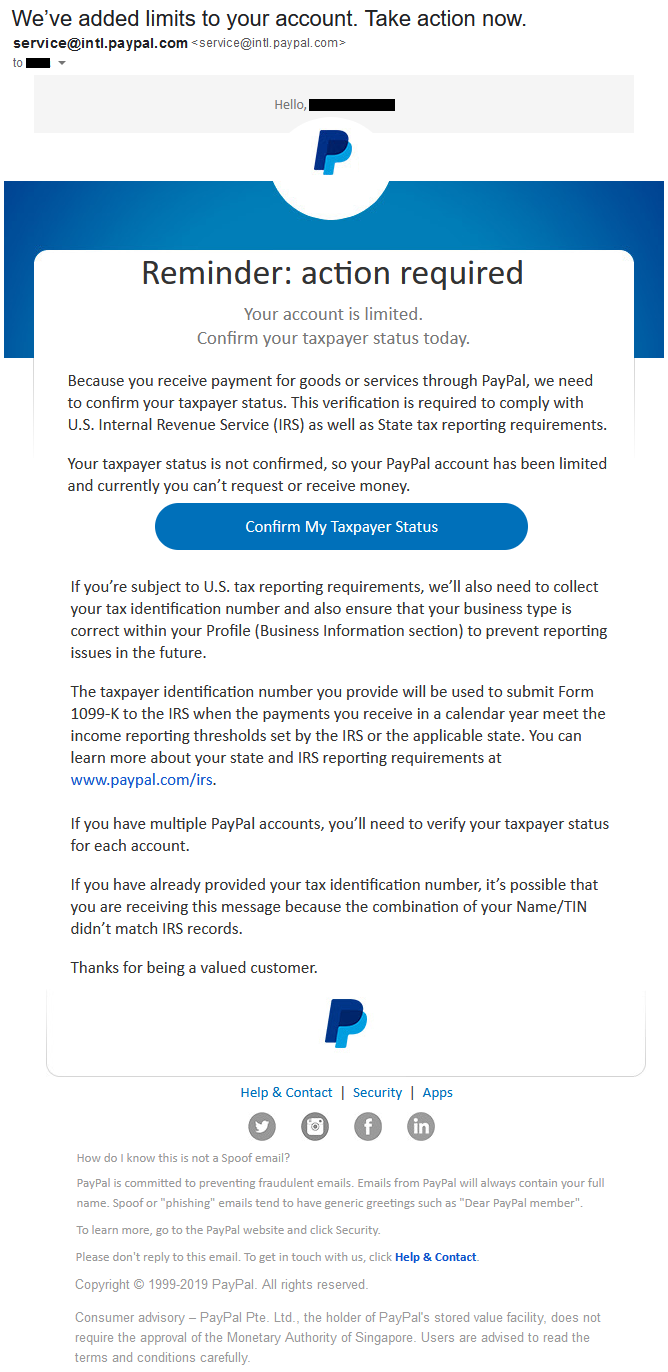

We’ve added limits to your account. Take action now

Reminder: action required

Your account is limited.

Confirm your taxpayer status today.Because you receive payment for goods or services through PayPal, we need to confirm your taxpayer status. This verification is required to comply with U.S. Internal Revenue Service (IRS) as well as State tax reporting requirements.

Your taxpayer status is not confirmed, so your PayPal account has been limited and currently you can’t request or receive money.

If you’re subject to U.S. tax reporting requirements, we’ll also need to collect your tax identification number and also ensure that your business type is correct within your Profile (Business Information section) to prevent reporting issues in the future.

The taxpayer identification number you provide will be used to submit Form 1099-K to the IRS when the payments you receive in a calendar year meet the income reporting thresholds set by the IRS or the applicable state. You can learn more about your state and IRS reporting requirements at www.paypal.com/irs.

If you have multiple PayPal accounts, you’ll need to verify your taxpayer status for each account.

If you have already provided your tax identification number, it’s possible that you are receiving this message because the combination of your Name/TIN didn’t match IRS records.

Thanks for being a valued customer.

I am not a US citizen

If you’re not a US citizen then you’ll still receive the email asking you for your taxpayer information, but then when you go on Paypal to submit this information there will be a field which you can select to tell Paypal that you’re not a US citizen, and that will be the end of that.

So you still need to go to Paypal and submit the form and claim a certificate for foreign status. You’ll just have to select a box that you’re not a US citizen falling under US tax laws, fill in your address, name and last name, and click the submit box. And then that’s it, you won’t need to submit any more information.

It’s that simple…

Certificate of Foreign Status Expiring/Renew

After you confirm your taxpayer status, you will have to renew it every few years.

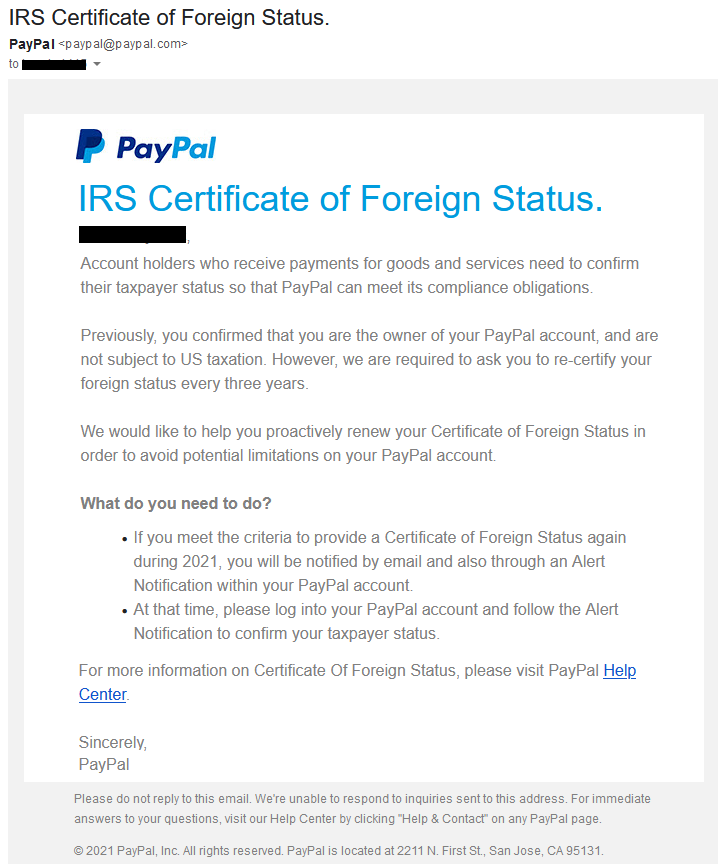

IRS Certificate of Foreign Status.

[NAME],

Account holders who receive payments for goods and services need to confirm their taxpayer status so that PayPal can meet its compliance obligations.

Previously, you confirmed that you are the owner of your PayPal account, and are not subject to US taxation. However, we are required to ask you to re-certify your foreign status every three years.

We would like to help you proactively renew your Certificate of Foreign Status in order to avoid potential limitations on your PayPal account.

What do you need to do?

If you meet the criteria to provide a Certificate of Foreign Status again during 2021, you will be notified by email and also through an Alert Notification within your PayPal account.

At that time, please log into your PayPal account and follow the Alert Notification to confirm your taxpayer status.For more information on Certificate Of Foreign Status, please visit PayPal Help Center.

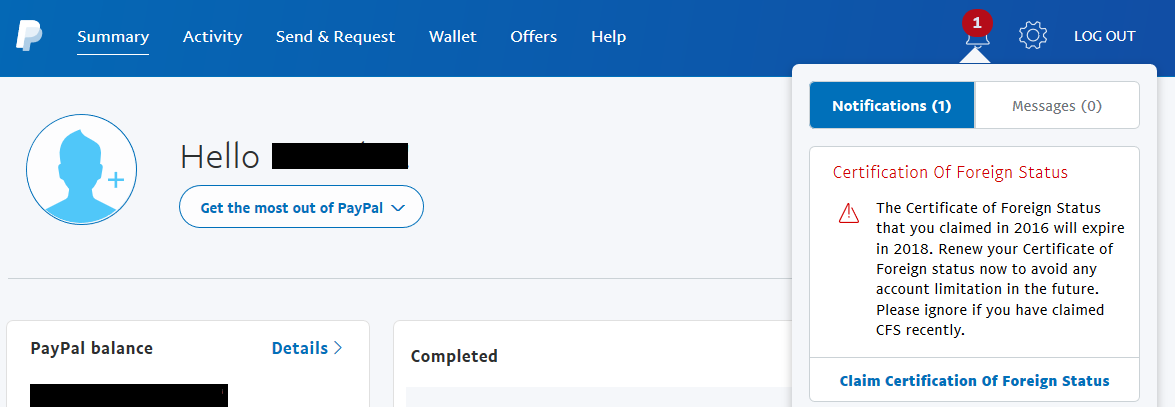

Certification Of Foreign Status

The certificate of Foreign Status that you claimed in 2016 will expire in 2018. Renew your Certificate of Foreign status now to avoid any account limitation in the future. Please ignore if you have claimed CFS recently.

Claim Certification Of Foreign Status

You just click the link and go through the steps, and it’s done. It only takes a minute and doesn’t require you to submit any personal documents or anything like that.

I am a US citizen

If you are a US citizen then you’ll have to fill out some info here. I don’t know exactly what, as I’ve never done this before.

Having said that, I would imagine you could just select that you’re not a US citizen and move on with your life. However, Paypal probably sends to the US all the information of every user from the US that uses their platform. So if you select that you’re not a US citizen, this will probably open you up to all sorts of trouble with the IRS. Ehhh 😒

I’m not entirely sure how it works if you have a double or triple nationality. Say if you hold a French and a US passport, and you opened your Paypal account with your French identity and information. I don’t have an answer as to what you would have to do in this case. You better consult a lawyer or simply look it up on Google in this case.

Thanks for providing your taxpayer information

After you’ve successfully submitted the information, you will receive an email like this:

Thank you

Thanks for providing the information we requested.

If you’re subject to U.S. tax reporting requirements, your taxpayer identification number will be used to prepare a Form 1099-K when it is necessary.

You can find more information about the Form 1099-K reporting rules and why we need your taxpayer identification number at www.paypal.com/irs.

And that is all folks 😀

Here is a video I made talking about this:

Conclusion

In conclusion, I would not want to be a US citizen haha. This whole thing about having to pay taxes to the US even if you leave the US and how you can never escape it just boggles the mind. It’s like they own you, like a slave. You don’t own me! How dare you!

And what’s worse is that you can’t really escape it because the US government has sway and power in all 4 corners of the globe. I mean, maybe you could escape it by going to Russia or China, but the moment you want to come back to the US or probably any other Western country, you’ll be dealing with a lot of trouble.

So be careful out there and stay safe guys 😉